ACCOUNTING

FOUNDATIONAL ACCOUNTING

- How Businesses are Valued

- Key Financial Metrics

- Accounting Management Resources

The Language of Business

Renowned Master Investor, Warren Buffet characterizes Accounting as the language of business, which begs the question, would you move to a foreign country and intentionally avoid learning the language, customs, and traditions? This analogy reflects the vitality of Business Owners possessing a foundational understanding of accounting.

Key Accounting Metrics

Key Account Metrics are select measurements that help managers and financial specialists analyze the business and track progress toward strategic goals. A wide variety of metrics are used by different businesses to help monitor their success and drive growth. For each company, it’s essential to track the metrics that are the most meaningful to its business.

Revenue

Revenue is the money generated from normal business operations, calculated as the average sales price times the number of units sold. It is the top line (or gross income) figure from which costs are subtracted to determine net income. Revenue is also known as sales on the income statement.

Cost of goods sold

Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs.

Gross Profit

Gross profit is the profit a company makes after deducting the costs associated with making and selling its products, or the costs associated with providing its services. Gross profit will appear on a company’s income statement and can be calculated by subtracting the cost of goods sold (COGS) from revenue (sales). These figures can be found on a company’s income statement. Gross profit may also be referred to as sales profit or gross income.

Overhead Expenses

Overhead refers to the ongoing business expenses not directly attributed to creating a product or service. It is important for budgeting purposes but also for determining how much a company must charge for its products or services to make a profit. In short, overhead is any expense incurred to support the business while not being directly related to a specific product or service.

Owner's Compensations

The wages a business owner pays themself for work done for the business.

- Wages/Salary

- Dividends

- Fringe Benefits

- Delayed Compensation

- Loans

E-B-I-T-D-A

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of profitability to net income. By stripping out the non-cash depreciation and amortization expense as well as taxes and debt costs dependent on the capital structure, EBITDA attempts to represent cash profit generated by the company’s operations.

Net Profit

Net profit describes the financial benefit realized when revenue generated from a business activity exceeds the expenses, costs, and taxes involved in sustaining the activity in question.

Open Accounts Receivable Balance

Accounts receivable (AR) are the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivable are listed on the balance sheet as a current asset. Any amount of money owed by customers for purchases made on credit is AR.

Open Accounts Payable Balance

Accounts payable (AP), or “payables,” refer to a company’s short-term obligations owed to its creditors or suppliers, which have not yet been paid. Payables appear on a company’s balance sheet as a current liability.

Working Capital

Working capital, also known as net working capital (NWC), is the difference between a company’s current assets—such as cash, accounts receivable/customers’ unpaid bills, and inventories of raw materials and finished goods—and its current liabilities, such as accounts payable and debts. It’s a commonly used measurement to gauge the short-term health of an organization.

KEY ACCOUNTING ROLES

To ensure that the right people are in the right positions doing the right things and the right time, it’s essential for business owners to understand the distinguishing functional responsibilities of the key roles that operate within the accounting arena.

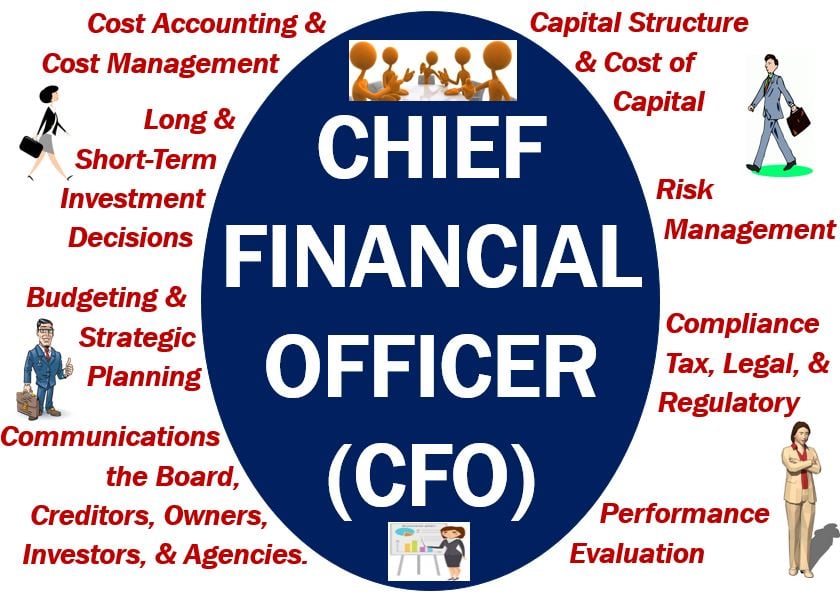

Chief Financial Officer (CFO)

Senior executive responsible for managing the financial actions of a company. The CFO’s duties include tracking cash flow and financial planning as well as analyzing the company’s financial strengths and weaknesses and proposing corrective actions. They are also responsible for ensuring that the company’s financial reports are accurate and completed in a timely manner.

Bookkeeper

Bookkeepers record a business’s day-to-day financial transactions.

Accountant

Accountants use their education and experience to create or examine the accuracy of financial statements, while ensuring that financial records and statements are in line with laws, regulations, and generally accepted accounting principles (GAAP). These records and statements may include the balance sheet, the profit and loss statement, the cash-flow statement, and tax returns.

Certified Public Accountant (CPA)

A certified public accountant (CPA) is a designation provided to licensed accounting professionals. The CPA license is provided by the Board of Accountancy for each state. The American Institute of Certified Public Accountants (AICPA) provides resources on obtaining the license. The CPA designation helps enforce professional standards in the accounting industry.

Tax Attorney

Tax attorneys guide individuals and corporations through legal matters related to taxes by helping them to understand their options and make sense of complicated tax codes, thus enabling them to meet their required tax obligations and filings while optimizing possible credits or deductions to lower those obligation.